May 19, 2023 10:49 pm | Updated 10:49 pm IST – New Delhi

(RBI) The Reserve Bank of India’s decision to remove 2000 rupee notes from circulation has sparked a wave of disapproval from opposition figures across the political spectrum. It was an unexpected and divisive action. With several voices strongly claiming that the November 2016 Demonetisation was an exercise doomed to failure from the outset, this development has once again brought the discussion regarding the effectiveness and effects of the Demonetisation into the limelight. Leading people have voiced their intense dissatisfaction with the withdrawal, including former Finance Minister P. Chidambaram, raising serious concerns about the government’s decision-making process and the enormous effects this will have on the economy.

Opposition Leaders Respond

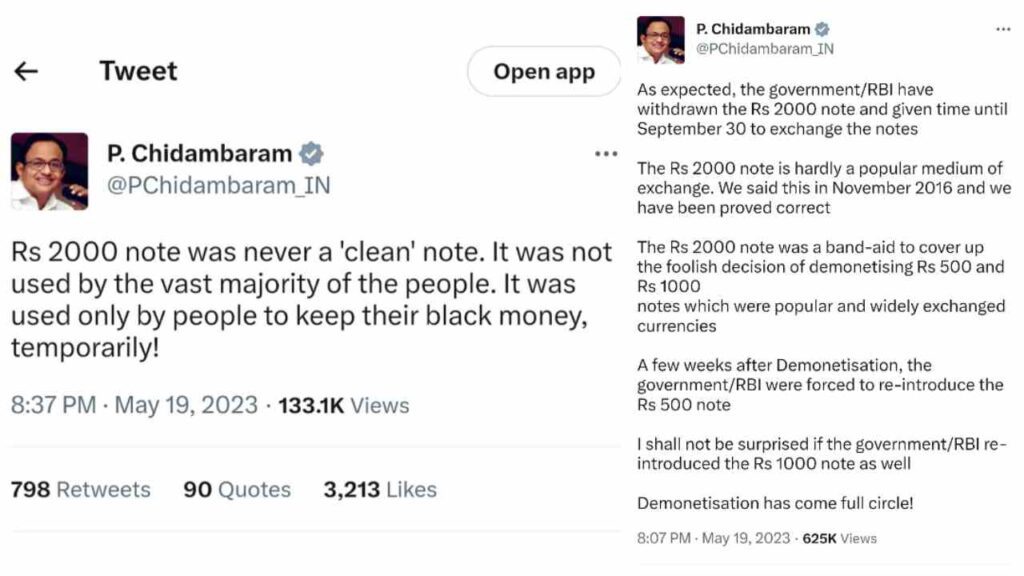

Chidambaram’s Twitter Response

P. Chidambaram, the former Finance Minister, took to Twitter to voice his concerns about the withdrawal of ₹2000 notes. He stated, “A few weeks after Demonetisation, the government/RBI were forced to re-introduce the ₹500 note. I shall not be surprised if the government/RBI re-introduced the ₹1000 note as well.” This statement suggests that Chidambaram sees the withdrawal as a full circle for demonetization, highlighting the government’s changing stance on the issue.

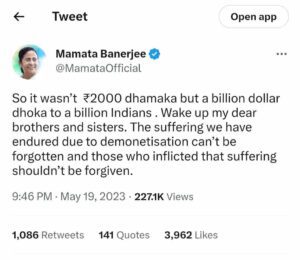

All India Trinamool Congress (AITC)’s Tweet

The official handle of the All India Trinamool Congress (AITC) tweeted, “@BJP4India demonetized ₹500 & ₹1000 notes in 2016, disrupting the lives of Indians everywhere! They claimed that the introduction of ₹2000 note would curb the flow of black money. 7 years later, they are withdrawing it from circulation. Yet another MODINOMIC masterstroke?” This tweet raises questions about the effectiveness of demonetization and implies that the withdrawal of ₹2000 notes contradict the government’s initial claims.

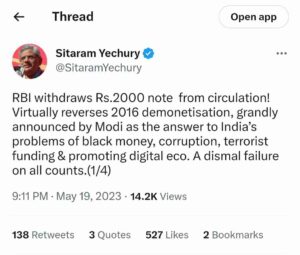

CPI (M) General Secretary Sitaram Yechury’s Tweet

Sitaram Yechury, the General Secretary of the Communist Party of India (Marxist), tagged his Rajya Sabha speech from 2016, in which he strongly opposed the note ban. In his tweet, he wrote, “RBI’s reversal of Modi demonetization is a vindication of what we said in 2016.” This statement indicates that Yechury views the RBI’s decision to withdraw ₹2000 notes as a validation of their earlier criticism.

AAP Minister Saurabh Bharadwaj’s Statement

Saurabh Bharadwaj, a minister from the Aam Aadmi Party (AAP) and the Delhi government, expressed his hopes that the latest decision was made by experts. He criticized the concept of starting and stopping the circulation of notes, attributing it to Prime Minister Narendra Modi’s actions and their negative impact on the economy. Bharadwaj claimed that demonetization failed to achieve its intended goals of curbing black money and ending terrorism.

Congress Spokesperson Pawan Khera’s Statement

Pawan Khera, a spokesperson for the Indian National Congress, referred to the withdrawal as the return of the “ghost of November 8, 2016.” He called demonetization a monumental disaster for the nation and criticized the government’s handling of the situation. Khera highlighted the unfulfilled promises made by the government regarding the benefits of the new ₹2000 notes and demanded an explanation for the sudden decision to discontinue their printing.

The RBI’s withdrawal of ₹2000 notes from circulation has sparked strong reactions from opposition leaders. Critics argue that this move proves their longstanding belief that the 2016 Demonetisation was a failed exercise.

Is the legal tender status of 2000 banknotes still in place?

Yes, The 2000 banknote will still be accepted as legal currency.

Can regular transactions be made using 2000 yen notes?

Yes, The general public can still use 2000 yen banknotes in everyday transactions and in exchange for goods and services. On or before September 30, 2023, they are urged to deposit and/or exchange their banknotes.

What should the general population do with the 2000-yen bills they possess?

The general public is welcome to visit bank branches to deposit and/or exchange any 2000-yen banknotes they may have. All banks will still offer the ability to deposit money into accounts and exchange them for 2000 rupee banknotes till September 30, 2023. Up to September 30, 2023, the exchange facility will also be accessible at the 19 RBI Regional Offices (ROs) with Issue Departments 1. until September 30, 2023.

Is there a limit to the number of banknotes that may be deposited into a bank account?

Deposits into bank accounts are permitted subject to existing Know Your Customer (KYC) regulations and other applicable statutory/regulatory procedures.

Can I swap 2000 bills through Business Correspondents (BCs)?

Yes, an account user can exchange 2000 banknotes through BCs up to a daily maximum of 4000/-.

When will the exchange facility be available?

Members of the public are encouraged to visit RBI bank branches or ROs beginning May 23, 2023, to allow time for banks to make necessary preparations.

Is a customer of the bank required in order to exchange 2000 banknotes at one of its locations?

No, a non-account holder can swap 2000 rupee bills at a time at any bank branch, up to a maximum of 20,000 rupees.

What if someone needs more than ₹20,000/- cash for business or other purposes?

Deposits into accounts can be made without restrictions. The ₹2000 banknotes can be deposited into bank accounts and cash requirements can be drawn thereafter, against these deposits.

Is there any fee to be paid for the exchange facility?

No. The exchange facility shall be provided free of cost.

Will there be specific exchange and deposit procedures for older individuals, those with impairments, and others?

Banks have been told to create preparations to make it easier for older folks, those with impairments, and others who want to exchange/deposit 2000 bills.

What happens if a 2000 bill cannot be deposited or exchanged right away?

To make the procedure simpler and more enjoyable for the people, a period of more than four months has been set out for the deposit and/or exchange of 2000 banknotes. Members of the public are therefore invited to use this service at their pleasure within the time allocated.

What if a bank declines to exchange or accept a deposit of a 2000 banknote?

In the event of a service shortcoming, the complainant / unhappy client should first contact the relevant bank. If the bank does not respond within 30 days of receiving the complaint, or if the complainant is dissatisfied with the bank’s response/resolution, the complainant may file a complaint under the Reserve Bank – Integrated Ombudsman Scheme (RB-IOS), 2021 at the RBI’s Complaint Management System portal.